This is the January 2023 edition of our monthly series of Ethics case studies titled What Do You Think? This series is comprised of case studies from NSPE archives, involving both real and hypothetical matters submitted by engineers, public officials and members of the public.

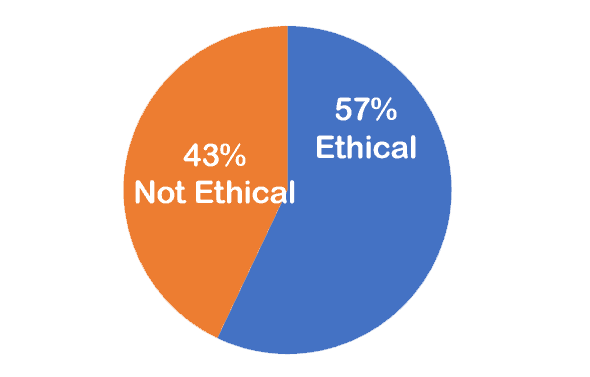

Your peers and the NSPE Board of Ethical Review have reviewed the facts of the case as shown below. And, here are the results.

Your opinion has been registered for the January 2023 edition of our monthly series of Ethics case studies titled What Do You Think?

Your vote is recorded as:

Want to know how your peers voted? We’ll send you an email with the poll results on January 24.

Your opinion has been registered for the January 2023 edition of our monthly series of Ethics case studies titled What Do You Think?

Your vote is recorded as:

Want to know how your peers voted? We’ll send you an email with the poll results on January 24.

A Review of the Facts

Engineer Albert, principal in ABC Engineers, P.A., retires and sells his stock to ABC. He takes a 25% down payment with the remaining balance to be paid over a period of five years.

After retirement, he offers his services to various clients as an advisory consultant—one who is not involved in design or planning, but rather assists them in decision-making. One of his responsibilities as an advisory consultant is to help clients select a consultant to do the design work.

Albert is involved in the interview of consulting firms and has informed his clients of his previous interest and continuing interest as far as the note receivable with the ABC firm is concerned. He then, on the basis of his judgment, recommends ABC for the commission to do design work on a project for a public agency, and ABC is retained.

Engineer Jimmy at a competing firm complains to the client on the basis that Albert has continuing financial interest in the ABC firm, because of the installment note arrangement, even though he has no voice in the direction or operation of the firm.

Is it ethical for Albert to be involved in the selection of the ABC firm under these circumstances?

Here is the result of our survey of your peers:

Applicable NSPE Code References:

III.1.e

Engineers shall not promote their own interest at the expense of the dignity and integrity of the profession.

III.4

Engineers shall not disclose, without consent, confidential information concerning the business affairs or technical processes of any present or former client or employer, or public body on which they serve.

II.4.a

Engineers shall disclose all known or potential conflicts of interest that could influence or appear to influence their judgment or the quality of their services.

II.4.b

Engineers shall not accept compensation, financial or otherwise, from more than one party for services on the same project, or for services pertaining to the same project, unless the circumstances are fully disclosed and agreed to by all interested parties.

Discussion

Taken in its simplest form, there is an economic conflict of interest on the part of Albert in recommending the retention of his former firm in light of his interest in having the firm receive the necessary fees to enable it to make good on its obligations to him. Whether that degree of conflict of interest, however, is barred by the cited code provisions is a somewhat more complex issue.

A review of the cited codes is in order:

Code III.4 turns upon disclosure of “confidential” information concerning the business affairs of the ABC firm. While it is technically true that the ABC firm is neither a former “client” nor a former “employer” of Albert, if those were determinative words, we would be inclined to apply the intent of the language to this case. However, there is no indication in the facts that Albert’s judgment in recommending his former firm related to “confidential” information concerning its business affairs. Yet we note that realistically, Albert could hardly help being influenced to some degree by his intimate knowledge of the business (and professional) operations of the ABC firm, and would be much less knowledgeable about the business and professional affairs of the competing firm.

Code II.4.a is basically a disclosure requirement, and we are told that Albert has made full disclosure of his prior relationship with the ABC firm to the clients he counsels. But there is another aspect of the wording of Code II.4.a which might properly lay the foundation for us to expand its meaning beyond disclosure. After stating the disclosure standard, the language goes on to state, “or appear to influence their judgment or the quality of their services.” If we read the word “or” and the following words with that kind of emphasis, we might logically conclude that Code II.4.a establishes two standards, (1) disclosure and (2) whether others might regard the circumstances as creating a conflict of interest. In that light, it is clear from the submitted facts that Jimmy did construe the facts as constituting a conflict of interest. The question would then recur as to whether Jimmy’s interpretation was “reasonable” under the stated facts.

Whether or not Code II.4.a should be read to cover both points, Code III.1.e provides a basis to conclude that in these circumstances where public funds are involved, the engineer should “avoid” the problem by not making the recommendation to retain the firm in which he has an economic interest. However, we observe that if the work was for a private owner, the required ethical standard would not be as severe in terms of the possibility of public suspicion. If the private owner, with full knowledge of the facts, was satisfied that there was no improper motivation on the part of the engineer, the disclosure standard would be sufficient.

Code II.4.b is also pertinent to the extent that it raises the question of whether Albert would be accepting compensation from more than one interested party for the same project. We believe the answer must be in the affirmative because Albert’s economic benefit comes from two sources regarding the selection of the ABC firm on his recommendation. He is paid by the client who was advised by him to retain the ABC firm, and he is being paid in part under the installment note from funds received from that client by reason of its selection on his advice. Unlike Code II.4.a, the language of Code II.4.b does not permit the conflict solely on the grounds of full disclosure. It goes on to require “agreed to by all interested parties.”

Is Jimmy an “interested party” within the meaning of Code II.4.b? In previous cases, we held that an architect who was the prime professional and who had retained an engineer for part of the design was an interested party when there was a dispute about the quality of the work performed by the engineer (Case 68-3). And in Case 68-12, we held that a land developer who had abandoned a project was an interested party. In both of those cases, the “interested party” had been directly involved in the project prior to the development of the problems, which led to ethical questions.

Here, however, Jimmy had no prior involvement in the project itself; his only interest was in seeking the assignment along with other competing firms. On that basis, therefore, we do not interpret “interested party” under these particular circumstances to extend to those who merely seek an assignment as distinguished from those directly involved in a project.

The Ethical Review Board’s Conclusion

It was not ethical for Albert to be involved in the selection of the firm under these circumstances.

BOARD OF ETHICAL REVIEW

Louis A. Bacon, P.E., F. Wendell Beard, P.E., James G. Johnstone, P.E., Robert H. Perrine, P.E., Marvin M. Specter, P.E.-L.S., L.W. Sprandel, P.E., Robert R. Evans, P.E., Chairman

Note – In regard to the question of application of the Code to corporations vis-a-vis real persons, business form or type should not negate nor influence conformance of individuals to the Code. The Code deals with professional services, which services must be performed by real persons. Real persons in turn establish and implement policies within business structures. The Code is clearly written to apply to the Engineer and it is incumbent on a member of NSPE to endeavor to live up to its provisions. This applies to all pertinent sections of the Code. This opinion is based on data submitted to the Board of Ethical Review and does not necessarily represent all of the pertinent facts when applied to a specific case. This opinion is for educational purposes only and should not be construed as expressing any opinion on the ethics of specific individuals. This opinion may be reprinted without further permission, provided that this statement is included before or after the text of the case.

Albert’s client was aware of the situation. Albert’s payment from firm that purchase his former firm I had assume was based on set payment schedule not depending on how the firm did (revenue) but basically an agreement similar to a bank loan.

The Key issue here, as pointed out by Terrance and others, is Albert’s payments are independent of his former firm’s performance, especially if secured by a bond or other guarantee. Nowhere is it stated that there is any financial connection other than the sale. If the firm goes bankrupt, we expect he would have a secured liability or other guarantee. Pending no other information, I believe the facts, as presented, allow Albert to ethically to continue his work.

He disclosed his continuing relationship with his former company. It is up to the public agency whether to take his advice; he is NOT the decision maker.

As to ethics, it is ethical to recommend another company to do the work if in your professional judement, you have legitiimate concerns about their ability to perform adequately, but feel you have to do so only because you just happened to have prior involvement with a company that, in your judgement, is competent and may be the only competent firm in the area?

Your ethical obligation is to your customer to recommend the best company for the work, in your professional opinion.

Certainly looks like a duck and walks like a duck, and even if he could be unbiased (big ig) the optics are terrible.

This discussion ignores the very real possibility that the competing firm was in reality a second best option, and that the recommendation of ABC was in the best interests of the client, The appearance of a conflict of interest is of concern, but to me the higher concern would be was I serving my client’s best interest if I recommended a firm that I thought was second best? This could be mitigated by being very specific as to the reasons for the choice of firms. A clear discussion of the relative merits of the two firms would do one of two things: Make it clear that ABC was the correct choice, or that Albert was acting unethically.

Jimmy’s compensation is not altered by his recommendation, unless you make the assumption that ABC is failing and without Jimmy’s recommendation ABC will fail. Jimmy told his new client of his history and that Client still trusted Jimmy’s judgement. The complaint should have been based on the merits of selecting the competition over ABC, that is how Jimmy’s selection was bias towards a lesser qualified company. The question should be could a reasonable engineer given the same task have arrived at the same solution? If yes, no ethical standards were violated.

The Board got it wrong.

Albert would receive his installment payments by contract without any additional work on his part. Those “payments” are essentially a retirement fund paid to Albert. If he had received the stock payout as a lump sum, and recommended ABC firm, there would be no violation? Also the amount of the “payments” for his stock will not change due to the recommendation back to ABC. So the transactions are unrelated. If Albert were receiving pension payments vs a stock buyout, would he be in violation? I believe the code is set up to prevent the engineer from recommending a firm and receiving a kickback payment. Clearly the “payments” Albert is receiving is not a kickback.

I did agree with the Board. However the comments presented so far by what I may call my peers are interesting and somewhat convincing that the Board had erred. None the less the entire situation just smells bad. Albert should have just recused himself from the assignment

The sentence “He then, on the basis of his judgement …” is key in my mind. If, by “his judgement” is meant he was truly using his professional, objective judgement to make the recommendation, then there was no financial conflict of interest. He was simply providing his client with what he determined to be the best choice for that client. Additionally, if he informed his clients of his interest in ABC ahead of time, they should be able to make the final decision and chose against his recommendation if desired when hiring a firm. Appearance to an outsider would be to the contrary, but the facts, as presented in the case anyway, imply he was unbiased and upfront, and therefore it appears to me he acted ethically.

Albert should have recused himself to avoid the appearance, if not actual, conflict of interest. While one can argue against there being an actual conflict of interest in this case, I do not see how anyone could argue that there is not the appearance of such a conflict.

“Code II.4.b is also pertinent to the extent that it raises the question of whether Albert would be accepting compensation from more than one interested party for the same project.”

I believe the Board may have gone rabbit hunting on this one! Albert sold his stock in ABC and received 25% down payment, and obviously a note for the remaining purchase price of the stock to be paid over a five-year term. We have no knowledge of the financial strength of ABC Engineers nor did Albert have a concern as he sold his stock with payment over time. Since we all have some assuming to do, the down payment with the balance over time would have been a tax liability decision. Since when is a loan repayment compensation?

Wrong decision Board! I served eight years on the Kentucky Licensing Board!

Missing from the information provided is whether he recommended only his former firm or provided a list of two or three possible firms. General practice would be to give more than one recommended firm.

As a retired owner/principal (and one of four founders) of a mid sized engineering firm, given the facts as stated I believe that Albert acted Ethically. He revealed to his client the details of his relationship with his former firm.

Assuming that his agreement with his former firm was similar to mine, the principals were personally liable to make the payments to Albert in full (If only the firm was liable to Albert, the principals could take all of the profits, not pay Albert ,nor any other retired principals, and declare bankruptcy. Hopefully Albert and his predecessors considered the integrity of their successors before making them principals. Therefore, Albert’s decision could not benefit him personally. I saw a similar thing happen with one of my clients. He claimed that his company owed me the unpaid bills and even though he was the sole owner of his company he had no liability for the unpaid bills. Legally, probably so, but ethically and morally, he did.).

Albert’s client obviously had no problem with his relationship with his former firm, otherwise Albert would not have been involved in the selection process.

Of course, if Albert knew that the firm was in financial difficulty, not stated in the facts, that is a whole different story. I assume that during his payout period, Albert was privy to the companies annual balance sheet, so he would have known.

It could be argued that Albert has a bias toward ABC to insure that they remain profitable so that he continues to receive the payments on the Note. Whether there is a bias or not, perception is reality in the eyes of competitors and the public. I agree with the finding of the Board.

When it comes to the public, even publicly-traded companies, appearances are critical. Though he disclosed (II.4.a), that’s not good enough. One could argue that he did have a financial interest in that the contract helped the firm stay afloat enough to pay him (II.4.b). It’s also “his old firm” and “his former partners” and probably friends and so on…and he chose a contract them (back to II.4.a). He should have acted on the side of caution and propriety. If the choice of firm was that obvious, he should have recused himself and the client would be fine; if it was that close, he should have recused himself to avoid undue personal bias. The board got it right.

He should be able to defend why ABC was selected from the others, not just an opinion. If he can show ABC has the right personnel, capabilities, availabilities, price, etc, then it’s ethical for his client to hire him knowing that going in. The client knows Albert’s going to get paid his money even if they dont go with ABC, so there’s nothing ethical about it.

Engineer Jimmy is a sore loser, plain and simple. Everything was open and above board.

Suppose we wait a while until Albert has received the last of his payments. Would any recommendation from him regarding ABC still be unethical on the basis that he has friends at ABC and has benefitted from them in the past? What changed other than Albert has stopped receiving a guaranteed payment for past work done?

It seems we’re splitting hairs, particularly as the basis for his recommendation to use ABC BASED ON HIS JUDGMENT does not seem in dispute.

The world runs on relationships and they can be messy. As long as Albert was upfront in disclosing potential conflicts and there are no other hidden conflicts, then I see no issue.

This is a hair line call. Albert provided full disclosure. Jimmy’s situation is weird. Even if he wins he could enter a project with an adversarial client relationship.

I served on numerous selection committees in which firms I had been associated with were evaluated. Some selected and some not. The problem here is the contractual arrangement. If my vote was the deciding factor I would probably err on the side of appearance of a conflict and recuse. if this was a selection committee I would submit my pro and con statements without a vote for or against selection

As usual, they don’t give us all the facts we’d like to make a decision. This is usually how it works in reality, which makes these good cases to discuss. I side with the board recommendation for a couple reasons. A bias is exactly that, a bias, and we can’t understand its true influence. So the comments about ‘as long as the recommendation was only on professional judgement, its ok’ miss the point that Albert cannot make a recommendation without that bias being present. Was the bias enough to tip the scales? We’ll never know which is why the ‘appearance’ of a conflict is the bar to get over rather than the unknowable ‘I put my biases aside to make this recommendation’.

What is more instructive imo are some of the comments here about how to deal with situations where there is clearly a potential appearance of influence. Recuse, but that could adversely impact his ability to consult in that geographical area (or maybe not). Provide multiple recommendations as viable options with the noted potential conflict. List out any special caveats that impacted the recommendation such as firm ABC has experience with “X”, none of the other firms have experience of this scale and scope and are not considered appropriate choices for this project.

Everything in life that you experience (where/how you grew up, the people you interfaced with, how you were taught, etc.) develops biases in each of us. It’s impossible to eliminate biases. The only thing we can do is try to make decisions while attempting to recognize and reduce those biases as much as possible. We can’t recuse ourselves for every bias we may have. In addition, as a capable advisor, it would make sense that he has developed experience working in this area, and with firms doing this type of work. Otherwise, how would he be considered an expert advisor? As such, he therefore has “biases” related to anybody he ever worked with and had associations with in this industry. It’s impossible not to be affected by all of those many biases over his life in making any decision. I’m not sure I understand why, if he was making a recommendation, it states he simply recommended his old firm — this seems non-standard. As a recommender, he should list all pros and cons of each option, which more clearly reduces any potential biases involve. If he truly said to just use ABC, then perhaps it is inappropriate, as the Board decided. But, assuming he provided pros and cons which pointed toward ABC being the best choice, I’d say he did nothing wrong, he was simply using his experience and knowledge to help with the decision.

In my opinion, that referral raises questions because the party making the referral still has a controlling interest in the company they are referring

Even if Albert was paid in full for retirement from ABC, I think the perception will continue that he would always favor ABC in a selection. Perhaps he should recuse himself from services that include “help clients select a consultant to do the design work.” when it will include ABC as competitor.

I think the Board overreached in this case and made a bad call that will likely encourage more complaints like this, which might be considered frivolous in court.

It appears to me that no harm was done to the public agency as a result of Albert recommending ABC for the project, since he had valid experience with ABC as a former principal, and there is nothing unethical about this case since Albert followed the ethics rules:

1. Albert did not promote his own interest at the expense of the dignity and integrity of the profession. He could have recommended another firm and would have been compensated the same, but only helped the agency based on his engineering experience and judgement.

2. Albert did not disclose, without consent, confidential information concerning the business affairs or technical processes of ABC.

3. Albert disclosed all known or potential conflicts of interest that would appear to influence his judgment.

4. Albert did not accept compensation, financial or otherwise, from more than one party for services on this project, or for services pertaining to the same project, and the circumstances concerning the apparent conflict of interest were fully disclosed and agreed to by all interested parties, which the Board agreed does not include Jimmy.

Jimmy might have been suspected of violating ethics rules since he did promote the interest of his firm at the expense of the dignity and integrity of the profession.

Obviously, Albert could have recused himself to avoid the appearance of a conflict of interest, but would that have served the best interest of his client? I think not. If Albert had not disclosed the potential conflict of interest, it would have been a clear ethical violation.

Paraphrasing Milton Friedman from Free to Choose, only two parties, i.e., the buyer and the seller, should be involved in a business transaction. In this case, no harm was done to either party, so the complaint from an outside competing party is not a violation of engineering ethics.